Taxation & Revenue

The Tax & Revenue Division serves as the central revenue collecting center for the City of Monroe and the political subdivisions throughout Ouachita Parish, including the Town of Sterlington, the Town of Richwood, the Ouachita Parish Police Jury, the City of Monroe School Board, the City of West Monroe, the Ouachita Parish School Board, and the Ouachita Parish Sheriff’s Office.

Our division collects the majority of the City’s General Fund Revenue. Those sources are mainly water bills, sales & use taxes, occupational & alcohol licenses, and property taxes in Monroe, LA. This Office is also contracted as a collection center for AT&T phone payments.

The Tax & Revenue Division is divided into processing, collections, and assessments. Our team of specialists is ready to assist the public in matters regarding filling out sales tax returns, answering questions regarding their property taxes, assisting with business-related issues, as well as other matters. Our team of cashiers interfaces with the public daily in collecting payments for water bills, licensing fees, parking tickets, sales tax, phone payments, and other miscellaneous payments. Citizens can make payments by walking in to see one of our cashiers or by driving up to the drive-thru window. Our audit team deals with ensuring that businesses located within Ouachita Parish (or conducting business in the parish) are compliant with local tax laws.

Helpful Links

Q: What are the requirements to start a business?

- Apply for a Certificate of Occupancy at the Planning and Zoning Department located at 3901 Jackson Street, Monroe, LA. For assistance and additional information, please contact our Planning and Zoning Department at 318-329-2212. The certificate fee is $75.00.

- Proceed to the Tax and Revenue office located at 316 Breard Street, Monroe, LA 71201 to apply for an Occupational License and a local sales tax number. Both the license and sales tax registrations are required before the business can be operational. To obtain an application click on the link below or pick one up at the Tax & Revenue office. If you need further assistance or would like to have an application faxed, please call our office 318-329-2220 and select option #3, Occupational & Alcohol licenses.

- Before the occupational license can be released, an inspection is required. If there are any violations discovered during the course of the inspection, the necessary corrections must be made and the Inspections Department notified for final inspection. For final inspection, call the Inspections Department at 318-329-2351 to schedule an appointment.

- Upon completion of the final inspection, present your final inspection copy (Yellow) to the Tax and Revenue office to receive your Occupational License.

Q: Are the license transferable?

Licenses are nontransferable and considered null and void if the company changes ownership.

Q: What is the cost associated with the license?

The licenses are based on type of business you are planning to operate in the City of Monroe. Refer to the reverse side of the application for an occupational license tax tables and the associated Louisiana Revised Statutes.

Q: How to obtain a tax id-number?

Tax-id numbers are assigned to every applicant that is classified as retail dealer, etc.

Q: When are licenses renewed?

Occupational Licenses must be renewed by the last day of February each year, with penalty & interest of 6.25% per month starting March 1st and continuing until license is paid.

Property taxes may be paid by mail, in person or online by visiting www.opso.net. For questions regarding payment, contact the Tax Office at 318-324-2536.

For more information, visit the Ouachita Parish Assessor website at www.opassessor.com .

If interested in purchasing City of Monroe adjudicated properties, please see the list posted to our website, or contact the City of Monroe Legal Department at 318-329-2240.

Resale Certificate Notice

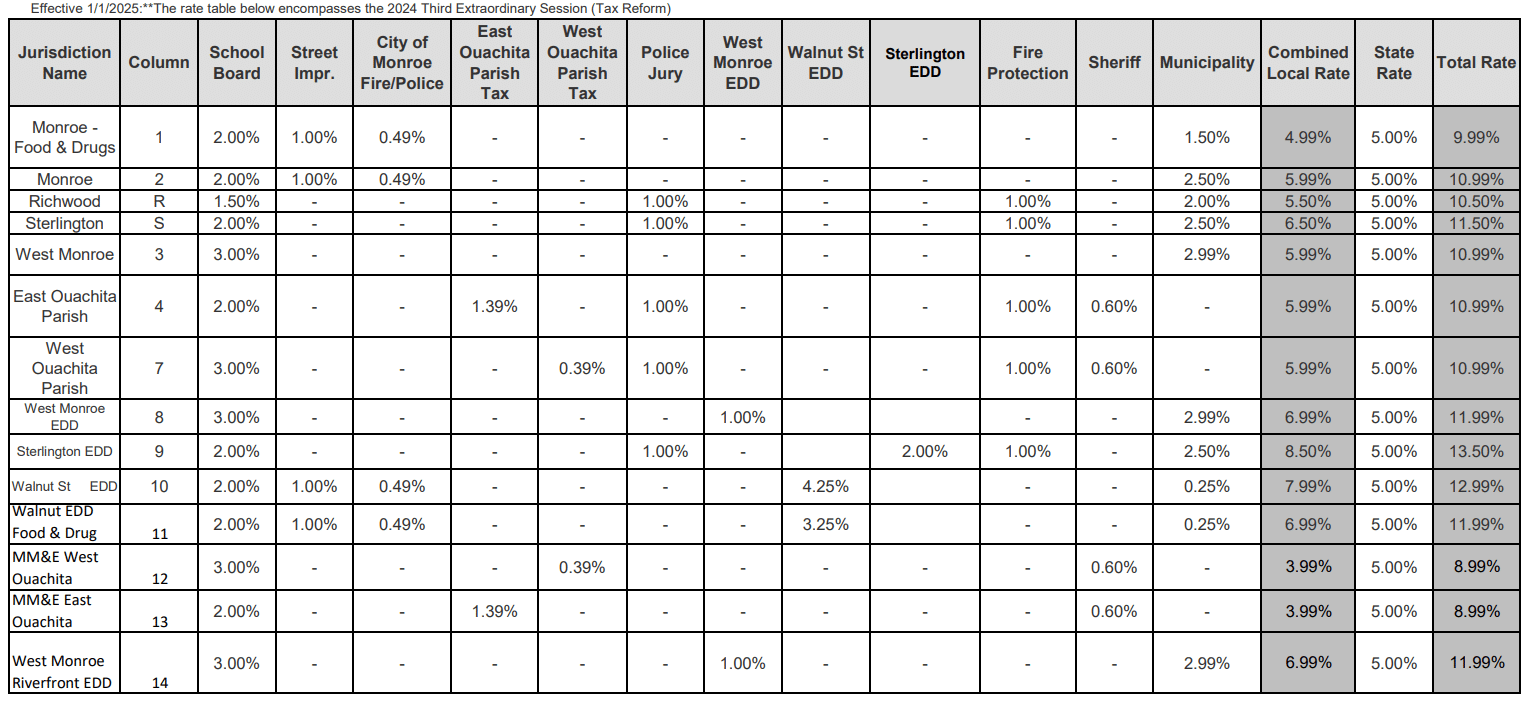

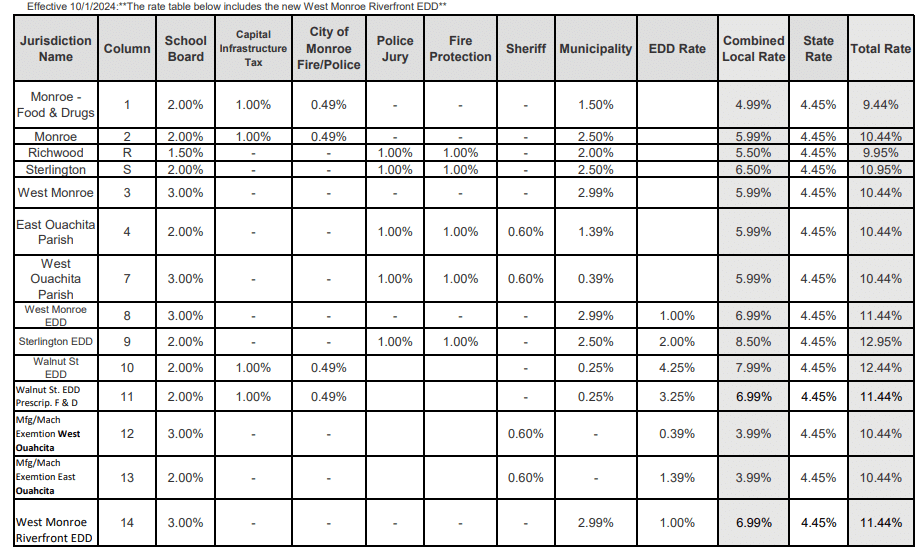

Q: What is the sales tax rate?

Effective October 1, 2024

Effective October 1, 2020

| LOCAL RATE | STATE RATE | TOTAL RATE | |

| City of Monroe | 5.99% | 4.45% | 10.44% |

| City of West Monroe | 5.99% | 4.45% | 10.44% |

| City of West Monroe EDD | 6.99% | 4.45% | 11.44% |

| East Ouachita Parish | 5.99% | 4.45% | 10.44% |

| West Ouachita Parish | 5.99% | 4.45% | 10.44% |

| Town of Sterlington | 6.50% | 4.45% | 10.95% |

| Town of Richwood | 5.50% | 4.45% | 9.95% |

| Sterling EED | 8.50% | 4.45% | 12.95% |

Effective April 1, 2019

| LOCAL RATE | STATE RATE | TOTAL RATE | |

| City of Monroe | 5.99% | 4.45% | 10.44% |

| City of West Monroe | 5.99% | 4.45% | 10.44% |

| City of West Monroe EDD | 6.99% | 4.45% | 11.44% |

| East Ouachita Parish | 5.99% | 4.45% | 10.44% |

| West Ouachita Parish | 5.99% | 4.45% | 10.44% |

| Town of Sterlington | 6.5% | 4.45% | 10.95% |

| Town of Richwood | 5.5% | 4.45% | 9.95% |

Effective April 1, 2018

| LOCAL RATE | STATE RATE | TOTAL RATE | |

| City of Monroe | 5.99% | 5.00% | 10.99% |

| City of West Monroe | 5.99% | 5.00% | 10.99% |

| East Ouachita Parish | 5.99% | 5.00% | 10.99% |

| West Ouachita Parish | 5.99% | 5.00% | 10.99% |

| Town of Sterlington | 6.50% | 5.00% | 11.50% |

| Town of Richwood | 5.50% | 5.00% | 10.50% |

Effective July 1, 2016

| LOCAL RATE | STATE RATE | TOTAL RATE | |

| City of Monroe | 5.99% | 5.00% | 10.99% |

| City of West Monroe | 5.99% | 5.00% | 10.99% |

| East Ouachita Parish | 4.60% | 5.00% | 9.60% |

| West Ouachita Parish | 5.99% | 5.00% | 10.99% |

| Town of Sterlington | 6.50% | 5.00% | 11.50% |

| Town of Richwood | 5.50% | 5.00% | 10.50% |

Q: How do I obtain local sales tax forms?

A: The sales/use tax forms can be mailed to you upon request by calling 318-329-2220, select option #2 Tax & Revenue, then option #2 Sales Tax; or can be picked up from the Tax & Revenue Division office located at the City Hall Annex Building, 316 Breard Street, Monroe, LA 71201.

Q: To what transactions is sales tax applied?

A: The sale of tangible personal property, the use, consumption, distribution, or storage for use or consumption of any tangible personal property, the lease or rental of any item or article of tangible personal property, the sales of certain services. All sales, use, consumption, distribution, storage for use or consumption, leases, and rentals of tangible personal property are taxable, unless an exemption or exclusion is provided by law for a particular transaction; only the particular transactions enumerated in the law are taxable.

Q: When are sales taxes due?

A: Sales tax are due the month following the collection month. A return is considered delinquent after the 20th of the month. If the 20th falls on a weekend or holiday, the return must be postmarked by the next business day to be considered paid on time.

Q: What is the sales tax penalty and interest rate?

A: The delinquent penalty is 5% for each 30 days late or fraction thereof and increases by 5% each month to a maximum of 25%. The interest is 1.25% per month or fraction thereof and increases by 1.25% on the 1st day of each month until paid.

Q: How do I remit the sales tax on a taxable purchase that I made which the vendor did not collect the tax?

A: If you are registered to collect and remit sales tax, the tax should be remitted directly to us by reporting the purchase amount on line 14 of the sales tax form.

Q: Are sales to churches and nonprofit organizations subject to sales tax?

A: Yes. Sales to churches and nonprofit organizations are subject to sales tax unless they are specifically exempted by statute. Refer to Louisiana Revised Statute Title 47 ‘305.14 for additional information.

Q: If I do not have any sales or purchases for a certain month or quarter, do I still need to file a sales tax return?

A: The answer to this question depends on your filing status. If you are an occasional filer, the answer is NO. If you are a monthly or quarterly filer, the answer is YES. A zero dollar return must be filed.

Q: What do I do to set up arrangements to pay an outstanding tax liability?

A: Contact our office at 318-329-2220 and select option #2 Tax & Revenue, then select option #5 for Sales Tax Audits.

Q: Do businesses with Internet sales have to collect local sales tax on their sales?

A: Internet sales are treated the same as catalog sales for sales tax purposes.